How do we quantify a thriving wage?

I've often heard, and have also adopted, the word "thriving" to describe the desired state of our communities. But I've never really seen anyone define what "thriving" means, especially when it comes to compensation. Someone surely has, though, so if you're out there (or if you know that someone), please let me know! I'll add it to our compensation equity resources compilation.

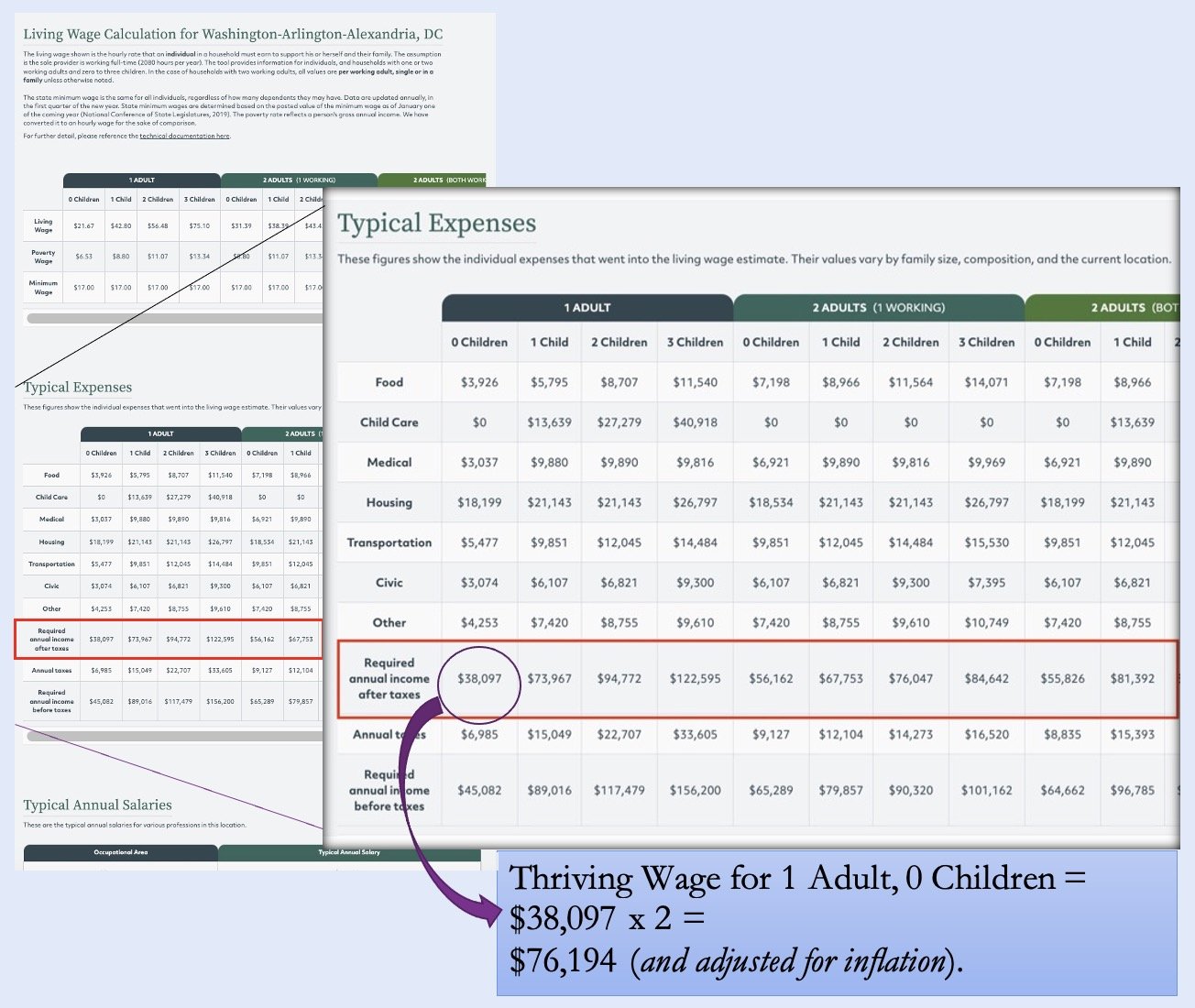

When it comes to compensation, the problem of defining "thriving wage" has been equally challenging. We know how to identify minimum wage and even living wage (thanks to Dr. Amy K. Glasmeier, who created the MIT Living Wage calculator). But not thriving wage.

Not having a definition of"thriving wage" is especially irksome to me because I want our framework to speak to a thriving wage, not minimum wage, living wage, or median wage. In our framework, we divide "salary" into two portions: one portion of everyone's salary is exactly the same: the base pay. And another portion of everyone's salary is differentiated, based on various, values-aligned compensation factors.

When clients asked me where they should set the base pay, I used to say somewhere between a living wage and the median wage (for a given geographic area). But something didn't sit quite right for me in that advice. Does somewhere between living wage and median wage truly allow people to thrive (which, after all, was my stated goal)? And my answer was no. The minimum wage isn't even a living wage, let alone a thriving wage. And a living wage also isn't enough.

Let me step back and explain.

Let's start with "living wage." When it was first introduced, the minimum wage was meant to be a living wage.

When the federal government passed the Fair Labor Standards Act in 1933 with a minimum wage standard, President Franklin Roosevelt said, "It seems to me to be equally plain that no business which depends for existence on paying less than living wages to its workers has any right to continue in this country...By living wages, I mean more than a bare subsistence level - I mean the wages of a decent living.

"The first minimum wage was $0.25/hour and went into effect in 1938. In today's dollars, that minimum wage is $5.22/hour. That equals an annual salary of $10,857.60/year.

Pop quiz: who among us can make a "decent living" on a salary of $10,857.60/year today, anywhere in the U.S.? Spoiler alert: no one.

Let's continue. The last federal minimum wage increase was in 2009, when the rate increased to $7.25/hour. And that amounts to $15,080/year. Also not, in FDR's words, "the wages of a decent living."

What about the living wage as defined by the MIT Living Wage calculator? Is that a thriving wage?

The MIT Living Wage documentation explains:

"The living wage model is an alternative measure of basic needs. It is a market-based approach that draws upon geographically specific expenditure data related to a family’s likely minimum food, childcare, health insurance, housing, transportation, and other basic necessities (e.g. clothing, personal care items, etc.) costs. The living wage draws on these cost elements and the rough effects of income and payroll taxes to determine the minimum employment earnings necessary to meet a family’s basic needs while also maintaining self-sufficiency."

The MIT Living Wage "exceeds the poverty threshold, often used to identify need." Living wage gets us closer to "enough," but it's still not "enough." Why? Because it only accounts for necessities. But every one of us has needs beyond necessities. For example, most of you have probably heard the statistic that the average American does not have the means to deal with a $1,000 emergency.

Another data point: sometimes I hear from leaders, "we just raised everyone's pay--and now they're asking for more." And that brings me back to the question of what income one needs in order to thrive. Perhaps it would be when folks felt they had enough. But how much is enough?

What salary and level of benefits would you need to feel like you had enough?

At what salary and benefits level would you stop scouring for opportunities to get a raise or switch to a higher-paying job?

At what salary and level of benefits do you need now to feel you have enough for your future? Your family's future? To save enough for retirement or whatever else you need to allay your financial anxieties?

There's no easy answer.

Earlier this year, I came across an article about the after-tax 50-30-20 budgeting rule. The rule is: budget 50% of your income for necessities, 30% for disposable income, and 20% for savings.

Using this rule, what if we back into what a thriving wage is? Given that necessities should account for 50% of our salary and the MIT Living Wage Calculator calculates for necessities, could we double the MIT Living Wage Calculator's after-tax estimate to get the after-tax income a person needs to have a thriving wage?

Aha! Now we have a working definition: a thriving wage is one that provides enough to pay for all their necessities, to have some disposable income, and to save for the future.

Now, as an employer, we can use this definition to assess whether our total compensation package (salary plus benefits*) provides a thriving wage. We can also articulate specific assumptions we're making through our employer philosophy and compensation philosophy.

We can compare apples to apples when we're assessing how to pay people in different geographic areas. Luckily, folks have done something similar to that (gobankingrates.com) for us already. Check out the version that the Sustainable Economies Law Center (SELC) used with a 60-20-20 budgeting rule (~9:20 minute mark).

Now it's your turn. How will you move toward paying all your staff a thriving wage?

Updated 6/19/2023*Only count the benefits that are accounted for in the living wage calculator. (Note: the MIT Living Wage calculator, in calculating health-related expenses for the basic needs budget, assumes an employer will subsidize some of the health insurance costs and that a worker will pay for some portion of the cost of an employer-sponsored plan, as well as other costs listed on the technical documentation page).